Introduction

The speed of the claim settlement process in insurance has significant importance. Policy holders often choose insurance plans that would provide them with quick claims in case of any mishappening, like a car accident, property damage, or medical emergency.

Traditionally, the claim settlement process in the insurance industry was done manually with the help of human resources, which often was filled with biases and took a longer time to complete.

With the introduction of generative AI in insurance, there has been an automation of the entire claim settlement process, making it less time-consuming and free of human biases and judgement.

This blog will help you understand how the claim settlement process has become faster with generative AI in insurance and the impact that generative AI has on the insurance industry.

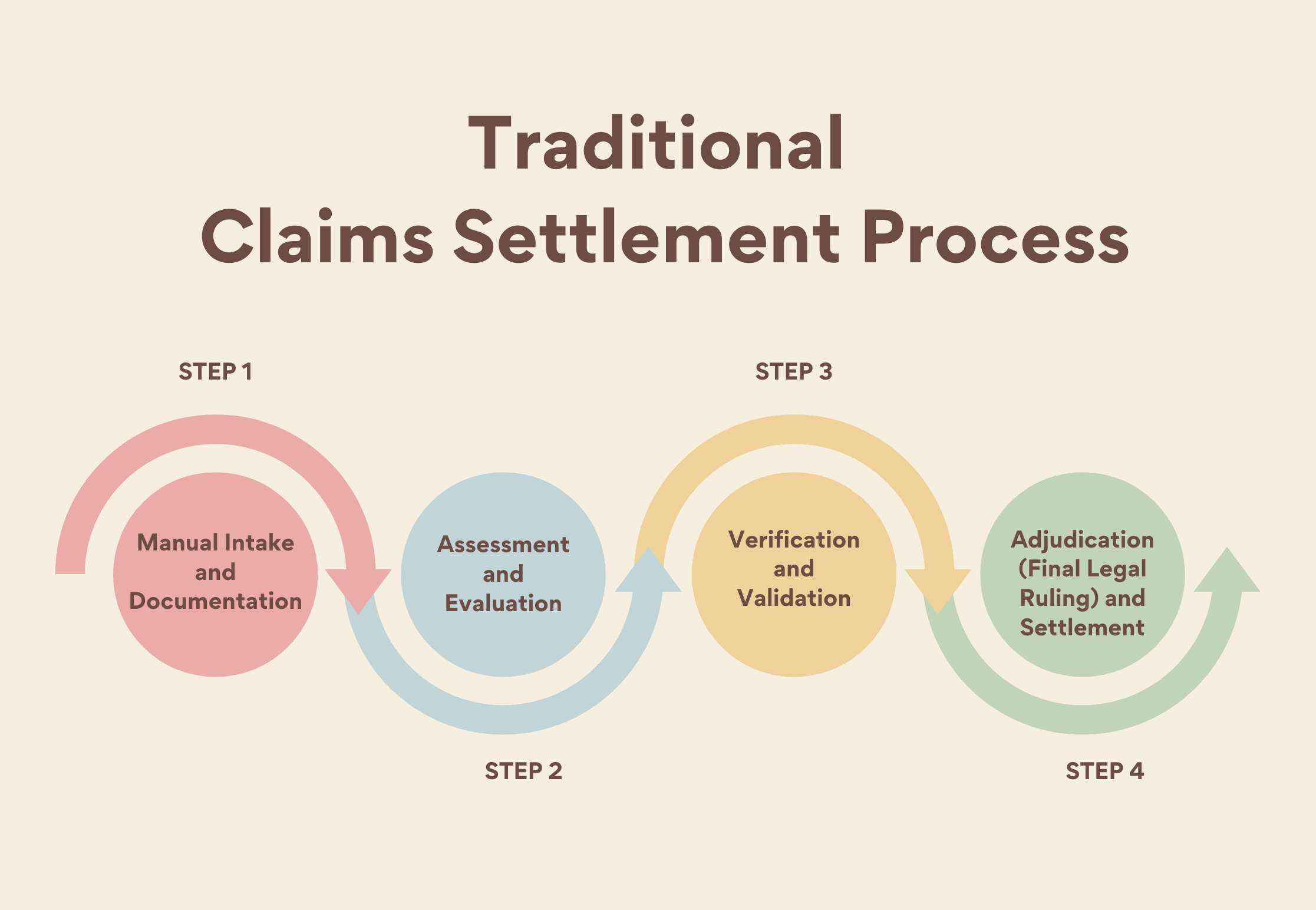

Traditional Claims Settlement Process

Before understanding the role of generative AI in the claim settlement process, let us first understand how various claims were traditionally settled in the insurance industry.

Manual Intake and Documentation

The first step in the traditional journey of the claim settlement process is the manual intake of information. When a policyholder wants to start a claim settlement process due to a mishappening, they are required to submit claim forms along with supporting documents like photographs.

Such claim forms and supporting documents are then assessed and processed by human agents of the insurance company.

The manual step of intake and documentation in the settlement process is extremely time-consuming and is also prone to many errors and inefficiencies.

Assessment and Evaluation

Once the policyholder provides the documents to the insurance company, the claim adjusters carefully review the details of the documents to assess the validity and the extent of the claim.

The process of assessment and evaluation involves the human agent to inspect damages, gather evidence and consult various sources to make appropriate and informed decisions.

The manual task of assessment and evaluation often led to many delays, specifically in cases that required extensive investigation due to their complex nature.

Verification and Validation

After the initial assessment regarding the validity and extent of the claim is completed, the claim process moves to the stage of verification and validation.

Subsequently, claim adjusters verify the policy coverage, investigate the circumstances of the incident, and authenticate the accuracy of the information provided.

Policyholders experience a considerable delay in the claim settlement process due to this stage, as this step involves the claim adjuster to communicate with various stakeholders such as policyholders, witnesses, and external experts.

Adjudication (Final Legal Ruling) and Settlement

Once the insurance company collects all the required information and validates its authenticity, the claims adjuster determines the settlement amount. The settlement amount is based on various factors such as, policy terms, coverage limits and the extent of the damages.

This step that involves decision-making regarding the settlement amount may require negotiations of the insurance company with the policyholder or third parties involved in the incident.

After the negotiations are finalized and a decision is made, the settlement is approved, and finally, the payment is disbursed to the claimant or policyholder.

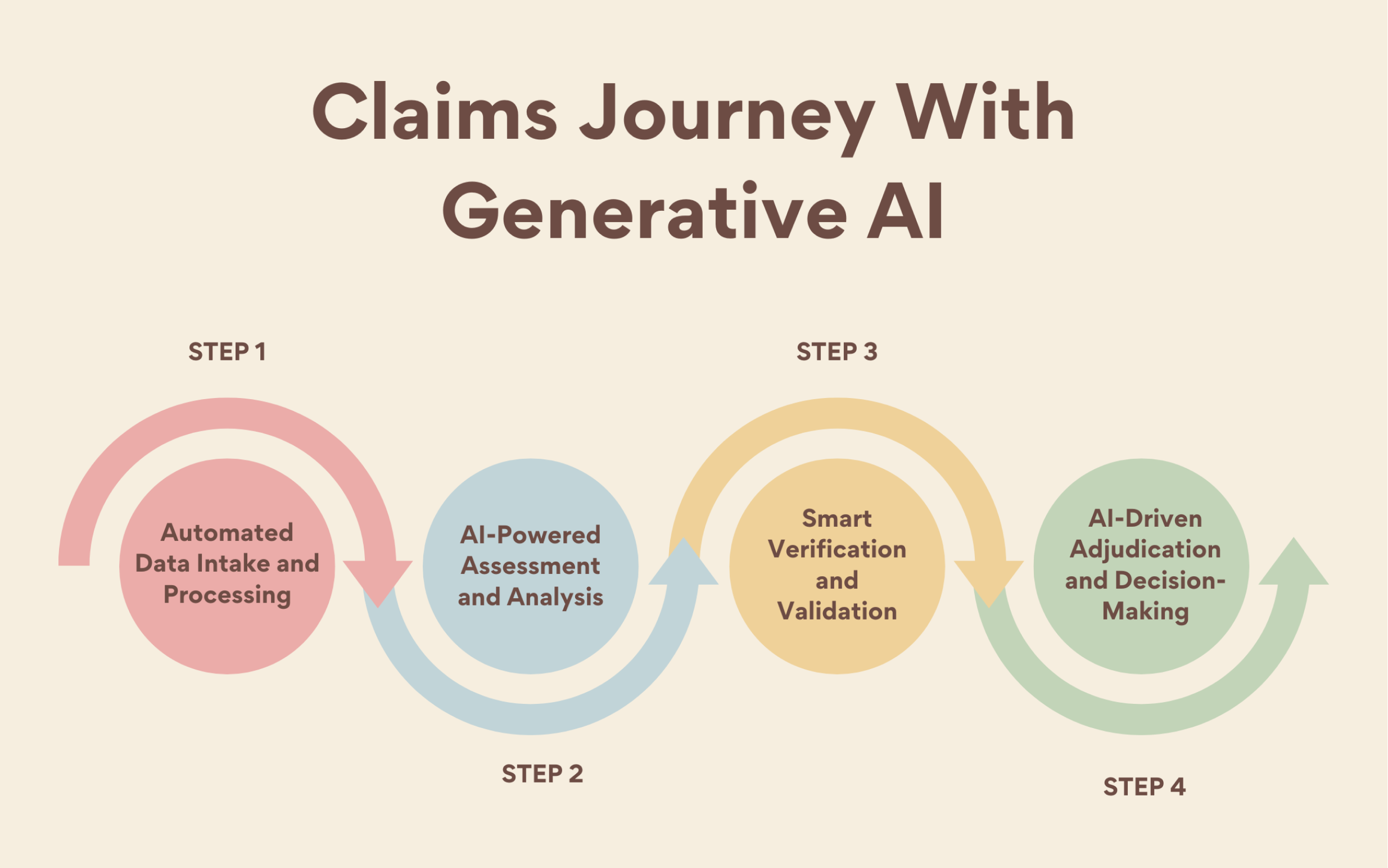

Claims Journey With Generative AI

Let us now explore how the claim settlement process in the insurance sector has become faster, more efficient, and more effective with the use of generative AI in insurance.

Fig.2

Automated Data Intake and Processing

With the introduction of generative AI in insurance, the insurance claims journey for a policyholder has been streamlined with the automation of data intake and processing.

With the help of NLP (Natural Language Processing) and OCR (Optical Character Recognition) solutions, AI algorithms are able to extract relevant information from the documents provided by the policyholder like claim forms, invoices, photographs and other documents.

As a result of generative AI in insurance, leading to the automation of data intake and streamlined claims workflows, insurance companies are able to reduce manual efforts and accelerate the initial stage of the claim settlement process.

AI-Powered Assessment and Analysis

Claim adjusters, with the help of generative AI in insurance, gain the opportunity to employ intelligent tools for assessment and analysis instead of completely relying on human judgement.

Machine learning in insurance uses various algorithms to analyze historical data, industry benchmarks, and real-time inputs.

Such analysis helps insurance companies to estimate claim values, identify various kinds of fraudulent patterns and prioritize high-risk cases for quick handling leading to faster claim settlements.

Smart Verification and Validation

With the help of generative AI in insurance, the stage of the verification and validation of the documents provided by the policyholder for claim settlement has become more accurate and efficient.

AI-powered claims processing algorithms cross-reference claim details against internal databases, external sources, and geospatial data.

With the help of such cross-reference that is facilitated by generative AI in insurance, insurance companies verify policy coverage, validate claim authenticity and detect inconsistencies or anomalies.

The automated verification and validation process helps insurance companies by improving fraud detection capabilities and minimizing delays, leading to faster claim settlement.

AI-Driven Adjudication and Decision-Making

Generative AI in insurance helps insurance companies with data-driven adjudication and decision-making.

By using advanced claims analytics like predictive analytics and probabilistic modelling, AI systems help the claim adjusters in assessing liability, optimizing negotiation strategies, and calculating settlements.

Real-time insights and scenario analysis tools have led to an improved customer experience due to faster and fairer claim resolutions.

Impact Of Generative AI In Insurance

Let us now find out the significant impact of generative AI in insurance industry by looking at the various benefits of generative AI in insurance.

Faster Claims Processing

One of the most significant impacts of generative AI in insurance is the acceleration that it has brought in the claim settlement process.

By automating manual tasks, streamlining claims workflows, and using advanced claim analytics like predictive analytics, AI considerably reduces the cycle time of claims processes and improves the overall efficiency of the insurance company.

Improved Fraud Detection

Generative AI in insurance plays a significant role in identifying and preventing insurance fraud. AI algorithms analyze a vast amount of data and identify subtle patterns that are indicative of fraudulent behaviour, thus helping the insurance company to easily detect potential fraudulent activities and suspicious claims early on.

The proactive approach that insurance companies undertake as a result of generative AI in insurance helps the companies to safeguard, and maintain the trust and integrity of the insurance ecosystem as well as minimize their financial losses.

Enhanced Customer Experience

Faster claims settlement processes and smooth interactions with AI customer support bots, helps to improve the overall customer experience in the insurance industry.

As a result of generative AI in insurance, policyholders are able to receive quick responses, transparent communication and personalized support through the entire claims journey leading to higher satisfaction and retention rates.

Further, with the help of AI-driven data and insights, insurers are able to anticipate customer needs and provide them with customized services and deliver proactive solutions. As a result, the insurance company gains long-term loyalty and an overall enhanced customer experience.

Cost Savings and Efficiency Gains

By automating repetitive and manual tasks, streamlining claims workflows and optimizing resource allocation, generative AI in insurance helps insurers improve their profitability by reducing operational costs.

With reduced amount of human interventions and streamlined workflows, insurance companies are able to handle higher volumes of cases with improved efficiency, leading to maximized productivity and scalability.

Further, with the help of AI-driven data and insights, insurance companies are able to identify process bottlenecks leading to optimized resource allocation and utilization which further leads to significant cost savings over time.

Conclusion

Generative AI in insurance has reshaped the entire landscape, specifically in the claims processing aspect, by making it quicker, more efficient, and transparent.

As a result of generative AI in insurance, insurance companies are also able to provide customers with more accurate, personalized, and customer-centric solutions that meet their needs and expectations.

Further, through optimized resource allocation and automation of repetitive and manual tasks, generative AI in insurance has made the entire insurance industry more efficient, trustworthy, and faster, leading to a great future for generative AI in insurance.

We at CrossML help the insurance industry by providing them with various generative AI solutions that help them speed up their claim settlement process, improve efficiency, and enhance overall customer experience, leading to higher profitability and cost savings.

FAQs

Generative AI accelerates claims processing by automating manual and repetitive tasks such as data intake, document analysis, and tedious decision-making tasks. Further, by using advanced AI algorithms and machine learning, AI systems are able to extract, categorize, and evaluate claim information quickly, leading to reduced processing times and helping insurers to handle higher volumes of claims more efficiently.

Generative AI ensures fairness and impartiality in claims assessment by relying on objective data analysis and predictive modelling by using generative AI in insurance. Traditionally, claims assessments were filled with human biases and judgements but with the use of GenAI in insurance, the assessment is based on predefined criteria, historical patterns and statistical probabilities. As a result, there is a reduced risk of discrimination or favoritism leading to an equitable treatment for all policyholders.

Generative AI can help in detecting fraudulent insurance claims by analyzing vast amounts of data to identify even subtle suspicious patterns, inconsistencies and anomalies. Machine learning algorithms are able to learn from historical fraud cases and continuously update their fraud detection capabilities due to their feature of continuous learning. As a result, insurance companies are able to detect emerging and potential fraudulent activities early on. Additionally, by flagging potential red flags early on, the insurance companies are able to promptly investigate suspicious activities and prevent fraudulent insurance pay-outs.

Generative AI contributes to faster insurance claims by streamlining the entire claims journey from the initial step of data intake to the final step of settlement. By automating repetitive and manual tasks, optimizing claims workflows, and providing real-time data-driven insights, AI algorithms speed up the processing time of claim settlement. Additionally, AI algorithms help reduce manual errors and accelerate the insurance company's decision-making process, benefitting policyholders. Through faster insurance claims, improved transparency, and smooth interactions, the policyholder also experiences an improvement in their overall customer experiences, leading to increased loyalty and retention rates.